How to Update Your EPF KYC Details Online

Registering on the UAN Members Portal

To update your KYC details online through the UAN Members Portal, the first step is to register your mobile number on the portal by generating an OTP (One Time Password). Once your mobile number is verified through OTP, you will be able to create your unique User ID and password for logging into the portal. Registration on the UAN portal allows employees universal access to their EPF details like passbook, claim forms, and ability to update KYC details like Aadhaar, PAN and bank account online from anywhere. This brings more convenience and transparency to managing EPF accounts compared to physically visiting EPFO offices.

Verifying and Completing KYC Details

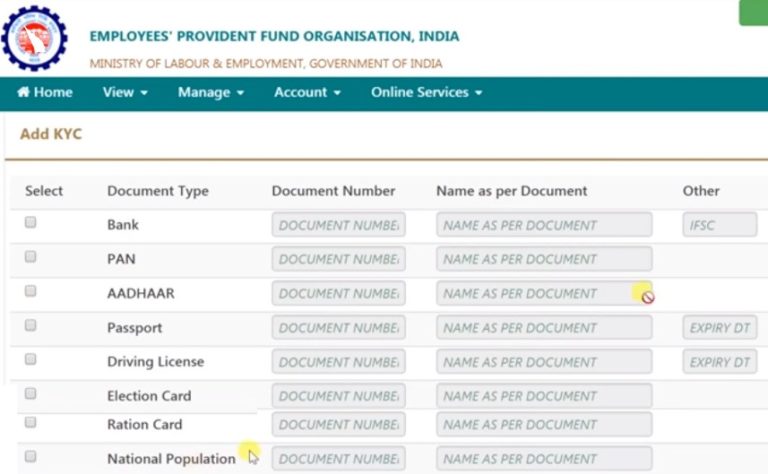

After logging into your UAN portal account, navigate to the ‘Manage’ section and select ‘KYC’ to view your existing KYC details. Here you will find your KYC documents marked as ‘Pending’ or ‘Approved’ by your employer.

You need to ensure all mandatory KYC details like Aadhaar, PAN and bank account are marked ‘Approved’ to avoid any issues with withdrawals or payments from your EPF account. If any detail is pending, you can upload the required document by clicking on ‘Submit’ next to it. Make sure to upload clear scanned copies of original documents for verification.

Some additional details like your address proof may not be mandatory but completing them can help establish your identity fully in the member records. Take time to cross-check that all filled details match your documents correctly before final submission.

Getting Employer Approval for Updated KYC

Once you submit the updated KYC documents online, it will be routed to your employer for verification and approval through their establishment portal. Employers are responsible for validating employee KYC details before approving the changes. The approval status can be checked by logging back into your UAN portal and navigating to the KYC section. Approved details will now reflect the latest updates you submitted. You may need to follow up with your employer if the status remains pending for a long time. An important point is that online KYC updation through UAN works best when both employee and employer coordinate timely. So remember to inform your employer about any KYC document updates for quick approval.

Benefits of Maintaining Updated KYC

Keeping KYC compliant is important to ensure smooth disbursal of EPF benefits like withdrawals, pensions and settlements. With more services becoming digital, updated KYC simplifies online access to EPF account details. It also prevents issues like mismatch of name or account numbers leading to problems in crediting contributions. Town employees reap greater benefits by keeping their KYC in order from the start of employment itself. So take some time to cross-check KYC details periodically and submit updates proactively via UAN online services. This helps future-proof EPF services and money according to changing needs over the lifetime of employment.

Using Bulk KYC Upload by Employers

For large establishments with multiple employees, getting individual KYC approvals can become tedious. In such cases, employers can leverage the bulk KYC upload functionality available on their portal.

This allows submitting KYC details of many employees together in one go through an excel template upload. After validation, the updated KYC gets reflected for all submitted members simultaneously post approval.

Bulk KYC significantly improves efficiency for both employer and employee organizations. It ensures KYC remains updated seamlessly in the background without requiring individual online uploads every time.

In summary, utilizing digital KYC services through UAN members portal brings higher convenience to EPF account management. Coordinating with employers helps validate updates faster and avoid issues down the line.