Consequences of Undeclared Large Cash Amount Brought Into India

Legality of Money Import and Local Regulations

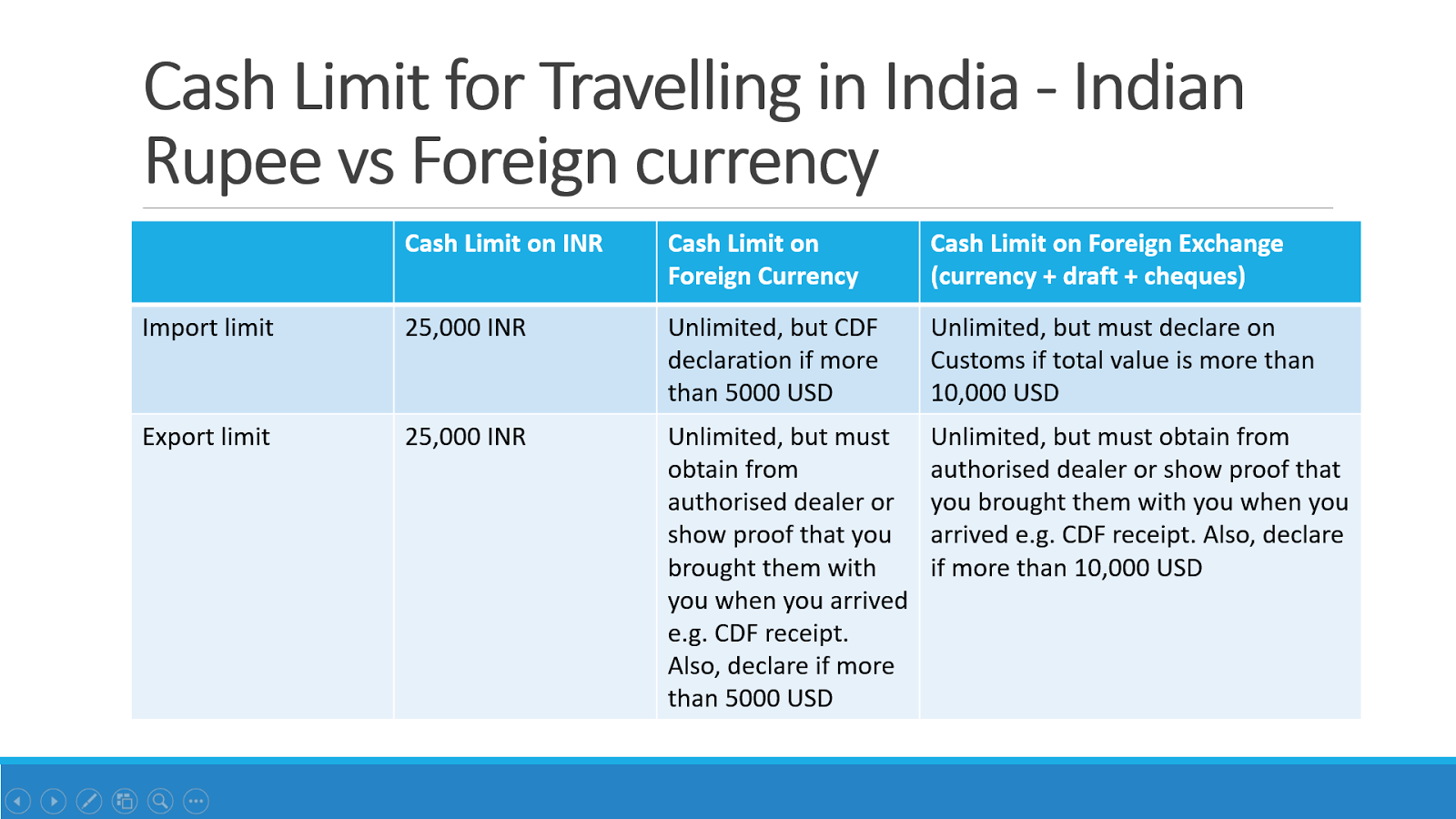

Bringing a large sum of money into India is not illegal as long as the funds are declared to the customs authorities as required by local regulations. The law does not specify a limit on how much cash one can bring into the country. However, regulations state that any amount that could be considered questionable should be declared by filling out a Currency Declaration Form (CDF) providing details such as the source of funds and identity of the traveler. If satisfied, customs may release the money and provide a receipt, or seal the cash for additional documentation verification later. Failure to declare as mandated could result in penalties.

Potential Issues with Non-Compliance

Not following the declaration procedure raises suspicions over the origins and intended use of large cash amounts. This may lead to temporary confiscation and investigation into the funds. If found to have legitimate sources and purpose, regulations were likely violated but the person may face fines instead of more severe punishment. However, questionable handling or origins could mean the money and individual are retained for thorough probe involving authorities of both countries concerned. Pending complete verification, prolonged legal processes might be experienced.

UK Laws and Cross-Border Notification

Besides local regulations, failure to abide by the home country’s rules for outbound travel cash limits may compound issues. The UK for instance requires declaring amounts over 10,000 Euros headed to India. If non-compliance is identified, authorities there could notify Indian customs, prompting immediate arrest on arrival until bail arrangement. Any criminal proceedings related overseas would similarly keep the individual under scrutiny locally.

Determining Legitimacy and Next Steps

The investigations aim to ascertain whether funds were earned legally and are meant for genuine business or personal use. Proof like bank transaction records help satisfy officials. Short of crimes, a sizable penalty proportional to the controverted amount gets imposed, with potential permission to recover money upon depositing equivalent value to the Indian government. Else, lengthy judicial custody and legal battle may be faced to reclaim cash. Passport too could see temporary impounding.

Lessons for Compliant Travel

The wise approach remains full transparency and documentation by following rules in both source and host nations. Alternative fund transfer options like wire transfers provide an digital audit trail safeguarding travelers. While bringing cash is not outlawed, its non-declaration raises red flags subjecting one to unnecessary scrutiny and inconvenience. Travelers are best served carrying only amounts needed abroad and leaving the rest wired as needed to ensure a hassle-free experience.

Summary

In conclusion, importing cash to India is legal with declaration but non-compliance attracts probes and possible prosecution depending on the case particulars. Maintaining integrity in financial activities and migrations helps avoid invitations of trouble. The long-term costs far exceed temporary benefits of concealment or rule breaking. Planning transfers judiciously with transparency serves travelers better for both safety and convenience.