How to Transfer Funds From Your Fixed Deposit to Your Savings Account in State Bank of India

Accessing Your Net Banking Portal

To start the process of transferring funds from your fixed deposit (FD) to your savings account, you’ll first need to log in to your Net Banking portal on the State Bank of India (SBI) website. To do so, enter your registered user ID and password. Once logged in, you’ll be able to access various account features and services directly from your online account dashboard.

Navigating to the Fixed Deposit Options

From the top navigation menu, select the “Fixed Deposit” option. This will expand a submenu with additional FD-related links. Click to open the submenu and look for an option labeled something like “Partially/Prematurely Close Fixed Deposit”. Selecting this link will take you to the partial closure process screen.

Providing the Details for the Partial FD Closure

On the partial closure screen, you’ll be asked to provide some key details. First, select the specific FD account you want to partially close from the drop down. Then enter the amount you wish to withdraw and close from the FD. Importantly, you’ll also need to specify the savings account where these withdrawn funds should be credited. Make sure to enter the full details of your linked savings account correctly.

Confirming the Partial FD Closure Request

Review all the details one last time to ensure everything is filled correctly before submitting your request. SBI may also display the applicable penalty charges if you are breaking the FD prematurely. Once satisfied, click “Submit” to officially initiate the partial FD closure process. SBI will process the request and credit the specified amount to your linked savings account within 2-3 working days.

Automatic Transfer of Remaining FD Amounts

In some cases, the FD closure amount may exceed your available balance in the linked savings account. In such a scenario, SBI has a helpful automatic transfer mechanism. It will use the remaining FD funds to top up your savings account balance directly. For example, if you request to close Rs. 10,000 but your savings account only has Rs. 5,000, SBI will deduct Rs. 5,000 from the FD and deposit the other Rs. 5,000 in your savings account automatically. This ensures seamless fund transfer without any rejected transactions.

Impact on Existing FDs Due to Premature Closure

If you partially or fully close an FD prematurely, it can impact your other active FDs with SBI. Once an existing FD is broken prematurely, all subsequent FDs that were created using funds from that FD will also be automatically closed by the bank. The amounts will then be credited to your linked savings account. So always keep this cascading effect in mind before initiating any premature FD closure with SBI online banking.

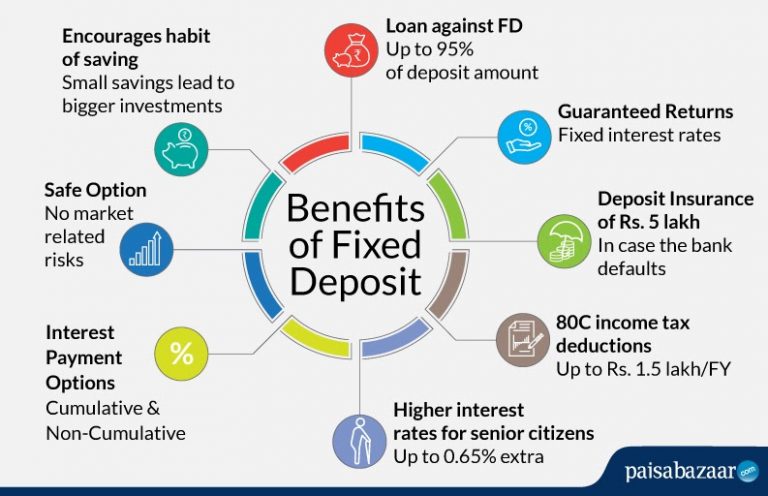

Benefits of Partial FD Closure Over a Full Withdrawal

Compared to fully closing an FD, opting for a partial closure allows you to maintain some funds in the fixed deposit scheme and continue earning higher interest on the remaining amount. You also avoid paying penalties on the untouched deposit sums. This flexible option provides access to some liquidity while still retaining the benefits of your bank FD investment. For urgent cash needs, partial FD closure via net banking offers a hassle-free solution.

Conclusion

By following the steps outlined above, account holders can effortlessly transfer funds locked in fixed deposits to their linked savings accounts digitally through SBI’s online banking portal. The partial closure process is quick and convenient. Just remember to accurately fill all mandatory details and preview requests to avoid rejections or incorrect transactions. With SBI’s automatic top up feature as well, partial FD closures ensure smooth fund transfers directly into your main transactional account.