Understanding the Complex Factors Behind Mining One Bitcoin

The Role of Mining Difficulty

The mining difficulty is a key factor that influences the CPU time required, as it indicates how challenging it is to find a valid block hash. Bitcoin mining difficulty automatically adjusts approximately every two weeks to maintain the average block generation time at 10 minutes. When more computational power joins the network, the difficulty increases proportionally to make mining harder. Conversely, if hash power decreases, mining becomes easier. This dynamic difficulty balancing mechanism ensures a stable and predictable Bitcoin mining process and block time.

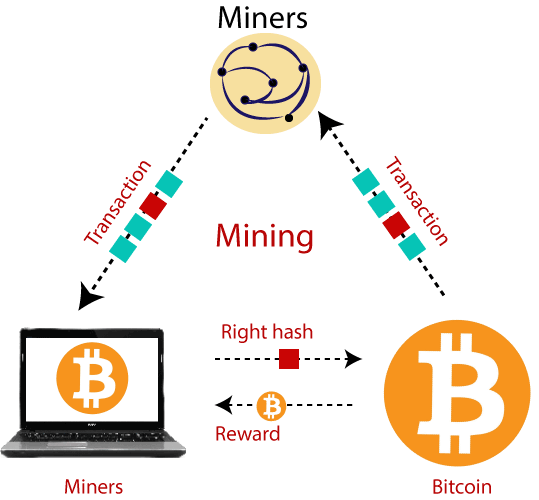

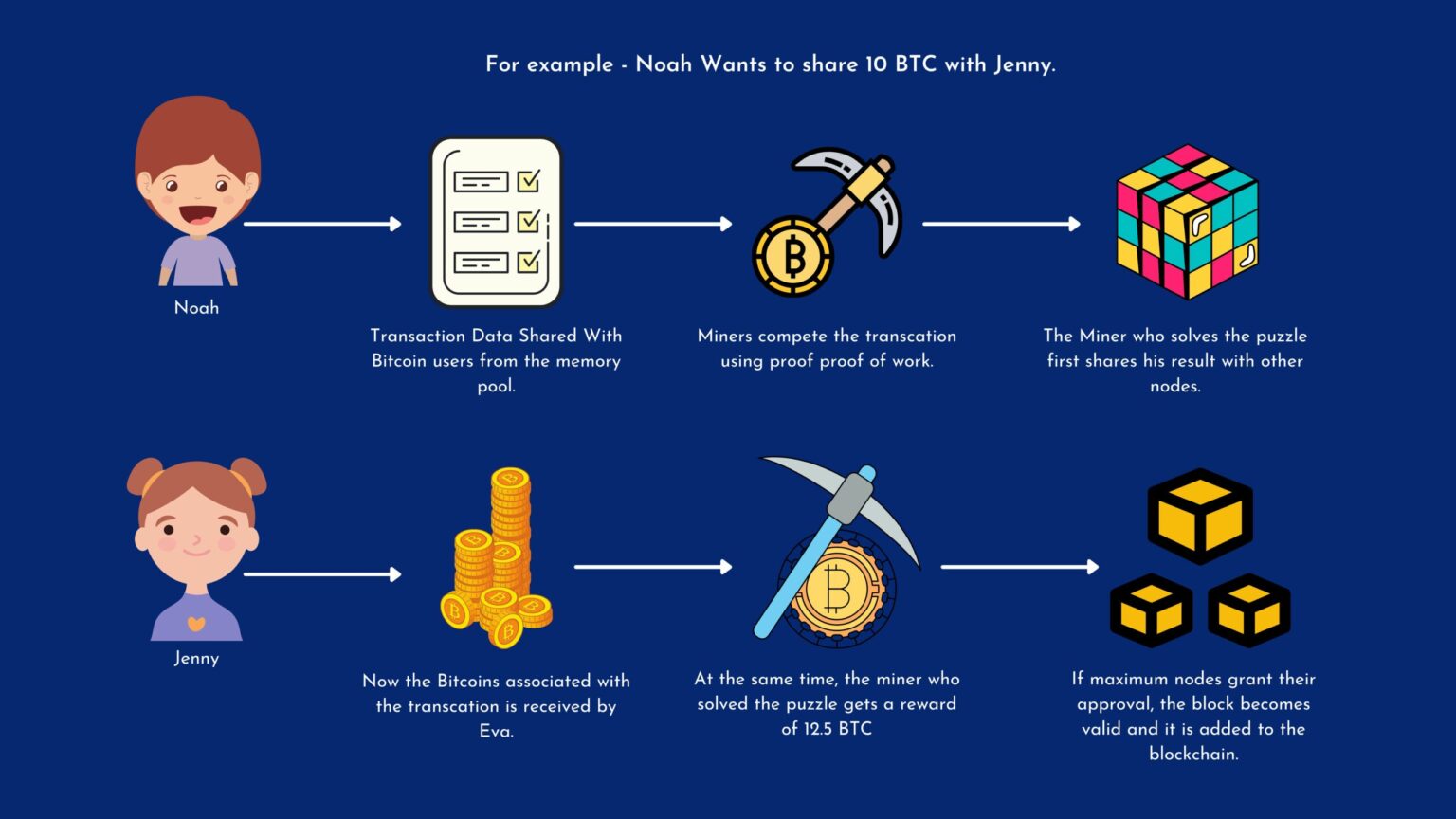

Bitcoin’s Proof-of-Work Algorithm

To earn mining rewards, miners must provide a valid proof-of-work by hashing the block header with a random nonce until the resulting hash satisfies the target difficulty criteria. Finding such a hash is a probabilistic process, and the odds of success decrease as difficulty rises. On average, miners will need to try many times before discovering a qualifying solution. As the network’s cumulative hash rate grows over time, more attempts are required to mine each block and maintain the 10-minute block time.

The Dominance of Mining ASICs

Bitcoin mining hardware ranges in processing capabilities and energy efficiency. Early miners utilized consumer CPUs and GPUs, but specialized ASICs now achieve vastly superior hash rates. ASICs optimized for the SHA-256 algorithm used in Bitcoin mining deliver thousands of times faster hashing speeds than general-purpose processors. Their dominance makes CPU and GPU mining obsolete for direct Bitcoin creation. The specific ASIC’s hashes per second directly impacts the CPU cycles needed to solve each block problem.

Fluctuations in Network Hash Rate

The constantly evolving network hash rate represents the total computational effort contributed by all miners worldwide. Growth indicates more people joining the mining community and difficulty rising accordingly. Declines happen when operations shut down due to insufficient returns. Short-term network fluctuations can alter a miner’s expected mining rewards by impacting the block discovery rate. Monitoring hash rate charts provides insights into mining conditions over time.

Participation in Mining Pools

Most amateur miners participate in mining pools to boost their probability of receiving regular payouts. Pools solve blocks collectively and share rewards proportional to each member’s contributed hashes. However, this means rewards get divided among more participants. Mining solo attempts to mine each block individually but comes with greater uncertainty. The chosen approach affects profitability calculations and predicted CPU hours to mine one bitcoin.

Reward Halving and Long-Term Mining Dynamics

Bitcoin’s supply issuance follows a pre-programmed emission schedule. Every 210,000 blocks mined or approximately every 4 years, the block reward halves to control overall coin generation. It started at 50 BTC per block in 2009 but is now 6.25 BTC and will reduce further over the decades. Each halving exponentially increases mining difficulty long-term by cutting monetary incentives. This continuous adjustment upwards of the CPU cycles needed demonstrates Bitcoin’s resilience against inflation.

Factoring Electricity and Profitability Considerations

The cost of electricity consumed by high-powered ASIC farms cannot be overlooked in determining mining feasibility. Bitcoin mining electricity costs vary significantly worldwide depending on regional energy rates and available renewable options. Profitability also relies on bitcoin’s market price holding above miners’ average total cost of production. Short-term price swings can impact mining operations’ viability and the viable rewards justifying extensive CPU power investment over time.

Conclusion

In summary, accurately predicting the CPU time necessary to mine one bitcoin is an impossibility given Bitcoin’s adaptive difficulty system and the numerous interconnected technological and economic variables constantly in flux. While specialized mining hardware like ASICs dominate direct bitcoin creation today, future innovations may alter these parameters. Overall, Bitcoin’s decentralized global computational network self-adjusts over the long run to remain secure and minimize individual miner revenue predictability through balanced incentive design. Understanding these complex interplays offers valuable insights into how the network operates and evolves through time.