Understanding Bitcoin Mining: The Process Behind Validating Transactions on the Blockchain

Bitcoin Mining is Solving Complex Mathematical Problems

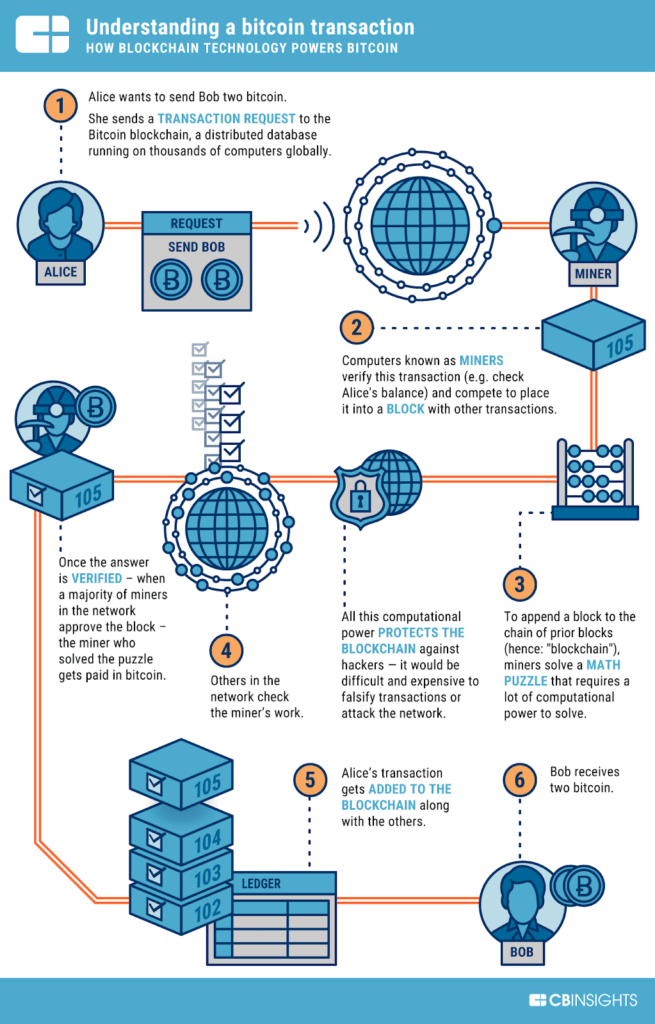

Bitcoin mining involves nodes on the network attempting to solve complex cryptographic math problems to validate transactions and mine new blocks. Miners are essentially guessing random numbers until one node finds a number that satisfies the problem’s conditions. This process is known as proof-of-work.

How Miners Validate Transactions

When miners take on a new block, the first step is to gather transactions from the pool of unconfirmed ones. Each transaction is then verified for authenticity and validity. This involves checking the sender’s balance and signature as well as the recipient’s ability to receive bitcoins. Valid transactions are grouped into a block along with a timestamp and reference to the previous block’s hash.

Building the Merkle Tree and Block Header

The miner then calculates the cryptographic hash of each individual transaction and combines them pair-wise to build a Merkle tree. This process continues halving the number of hashes until a single value called the Merkle root is derived. The block header is then constructed containing the Merkle root, previous block hash, nonce and other metadata.

Hashing the Block Header Until a Valid Proof-of-Work is Found

This block header undergoes the cryptographic hashing algorithm to produce a number called a “hash”. For the block to be valid, this hash must meet the network’s difficulty criteria which is purposefully set very high. Miners tweak the nonce and rehash until a valid proof-of-work emerges, which other nodes can easily verify.

Mining Rewards and Competition to Solve Problems First

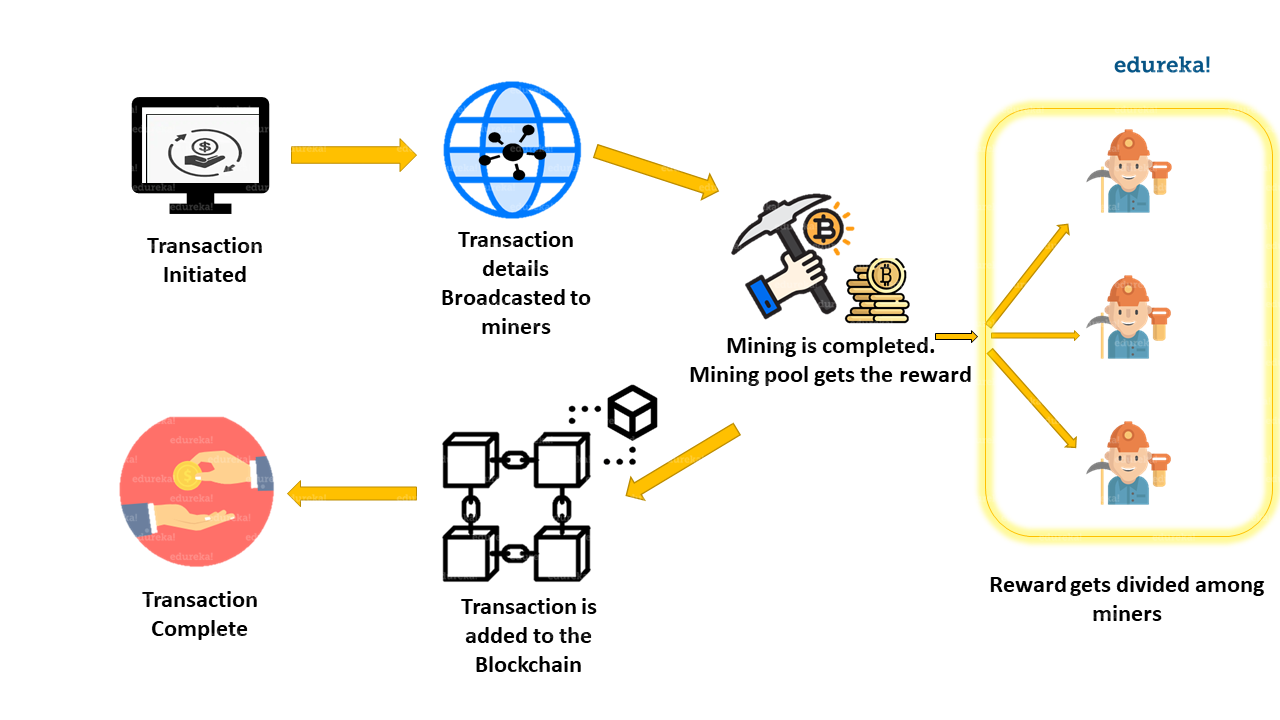

The first miner to solve the proof-of-work gets to attach their block to the blockchain and claim the mining reward of newly generated bitcoins plus fees. Other nodes then switch efforts to building the next block. With thousands of miners competing globally, this has become an industrialized arms race requiring specialized hardware.

Optimizing for Efficiency and Profits in a Competitive Landscape

Miners seek the most cost-effective solutions balancing the upfront costs of equipment against operational expenses like electricity. Geographical advantages leveraging renewable energy are key. Multiple computers combine their hashing power through mining pools for steady rewards. Modeling hardware profitability over time also reveals equipment purchase as the bigger investment than electricity.

Maintaining Distributed Consensus Through Ever-Rising Difficulty

As more miners join, validating a block grows exponentially harder through automatic difficulty adjustments roughly every two weeks. This balancing mechanism ensures blocks are mined at a stable average rate of one every 10 minutes across the network. The collaboration of miners worldwide secures bitcoin in a decentralized manner through proof-of-work.

Long-term Uncertainties but Great Learning Opportunity

Participating as an educational hobby revealed crypto mining’s complexities and evolution over time. While current profitability is unpredictable, the project paid back initial costs and more through gained knowledge. Bitcoin after eight years still testing real-world application but inspires continued technical progress in distributed consensus models.