Will CFA Surpass MBA as the Top Finance Qualification?

Investment Banking: More Than Just Theory

While certifications like CFA teach financial theory, the real world of investment banking is about practical application and selling yourself. Commercial acumen and people skills are crucial to success over analytical credentials alone. Landing your first job requires networking, persuasion during interviews, and convincing hiring managers you have the interpersonal attributes for client-facing roles. Certifications act as screening mechanisms initially but interviews determine who gets hired. Technical knowledge alone won’t sell complex deals - you need charisma and confidence dealing with high-net-worth individuals. Later in your career, continuing education stays relevant but workplace performance defines your prospects more than entry qualifications. Analytical firepower from exams soon levels out between peers. Demonstrating critical thinking, problem-solving abilities and initiative on live projects separates high-flyers from average performers.

Leveraging Theoretical Grounding for Practical Applications

While certifications introduce financial concepts, the skill lies in applying learned frameworks to real-world scenarios. With a CFA, one enters the industry ahead of peers unfamiliar with key terms. You can leverage your theoretical grounding to grasp new responsibilities faster and offer value-added insights appreciated by senior managers. Over time, as others catch up academically, maintaining expertise requires independently researching cutting-edge ideas and industries. Continuing education keeps you knowledgeable on the latest tools, regulations and macroeconomic conditions shaping capital markets. A solid grasp of ever-evolving variables ensures you provide sophisticated advisory suited to dynamic client risk profiles and objectives.

Strengthening Credentials with Experience

Initial certification success may land entry-level opportunities but career progress demands consistent performance. Early responsibilities often involve junior analysis, research tasks or operational/administrative functions. Proving yourself on these foundations elevates your credibility for more complex mandate origination, M&A execution or C-suite advisory roles. Inevitably, some certifications holders plateau professionally if relying on qualifications alone. Strong graduates distinguish themselves by aggressive skill and knowledge upgrading aligned with employers’ transformation. Ambitious individuals complement credentials with value-adding specializations like CIM, CAIA or CFP to multi-skill into niche competencies better addressing evolving client needs.

Networking Advantages of Professional Associations

Beyond exams, certification bodies like CFA Institute offer invaluable post-graduate networks. Connecting with peers worldwide expands your professional circle and industry visibility. Seminars co-hosted with big-name alumni showcase your credentials to prospective bosses.

Active contributors to the organization’s thought leadership through published commentary or conference speaking gain repute among senior influencers. Such engagement burnishes your personal brand recognition as a domain expert. It also opens doors to mentorship from accomplished charterholders propelling careers of up-and-coming professionals.

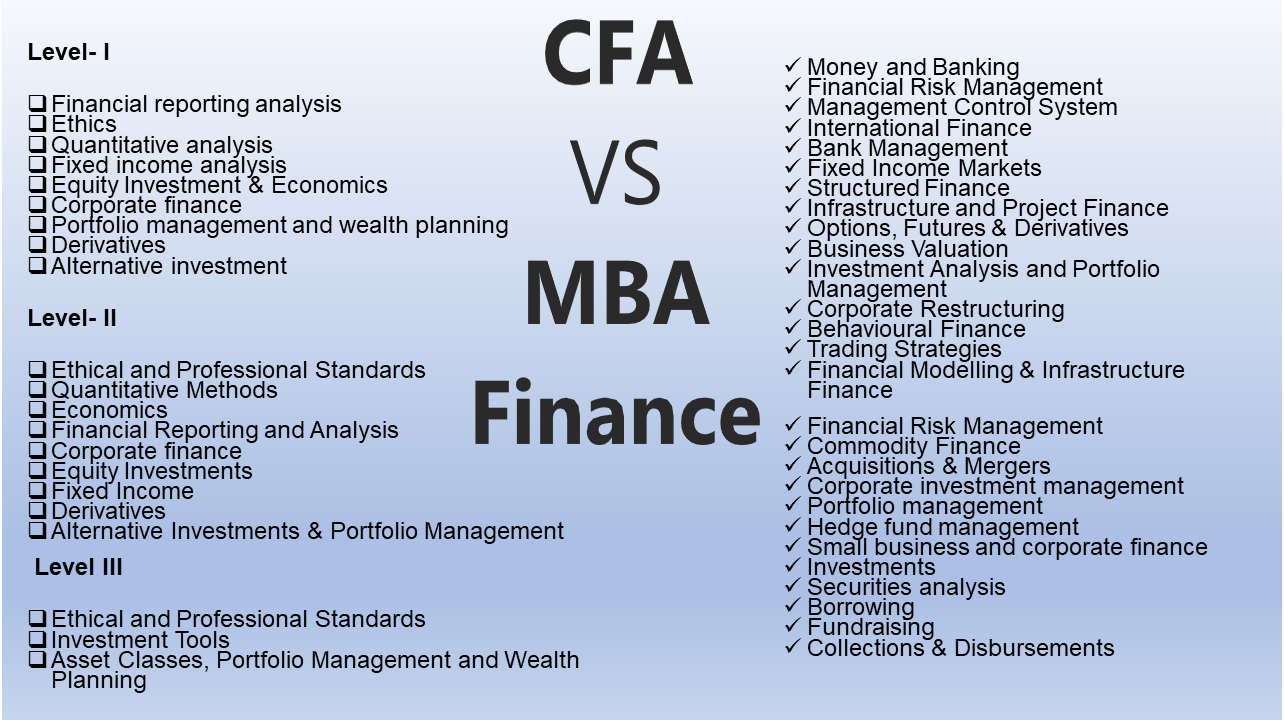

Flexible Study Pathways Supporting Career Evolution

CFA adapts well to dynamic schedules versus rigid MBA timetables. Busy executives can pace study over multiple sittings instead of blocking off years. Modular learning allows incorporating prep into daily routines versus intensive courses. Pausing/restarting is flexible if priorities shift but motivates self-discipline towards the goal. Changing specializations like pivot from asset management to private wealth implies retooling. CFA provides versatile financial acumen applicable across sectors. MBAs specialize students into narrow silos while the CFA designates T-shaped individuals with broad analysis abilities and depth in one field. Versatile skillsets suitably redeploy throughout careers in flux.

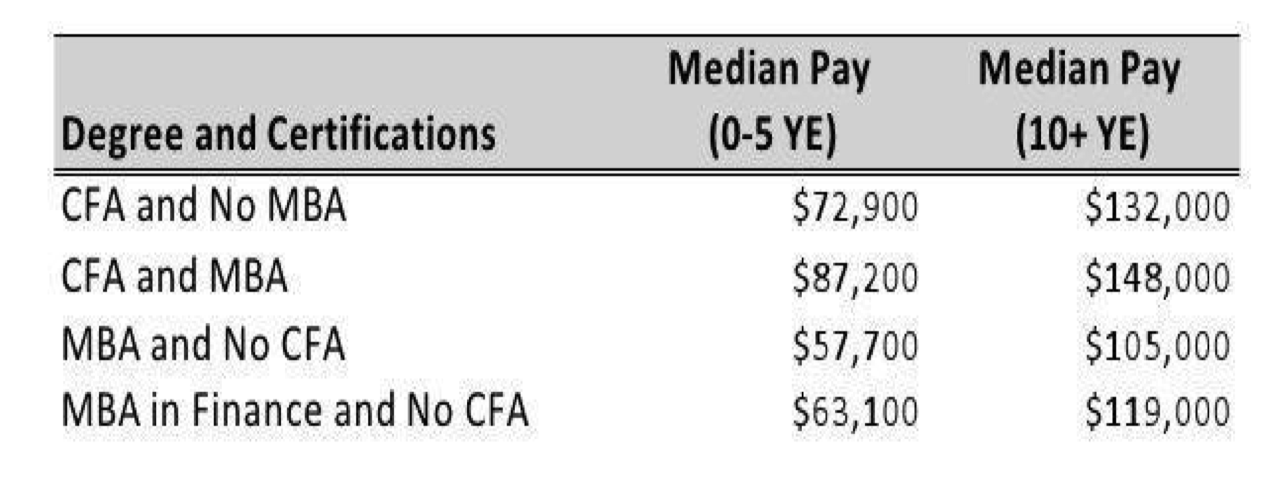

Value Compared to MBA Costs and Time Commitment

CFA costs a fraction of MBAs and can be pursued part-time without career interruptions. Each exam level costs around $1000 versus $150,000 in foregone wages, tuition fees and living expenses for a full-time MBA. Less time-consuming CFA preparation makes it ideal while established in the industry versus sacrificing years from the workforce.

Accelerated online MBAs may cost closer to $50,000 but offer limited networking and experiential learning. CFA candidates benefit from self-study flexibility and globally renowned credentials respected by employers worldwide. Its rigors also impart strong work ethics, grit and determination valued by hiring managers.

Financial Industry Demand Boosts CFA Prestige

Proliferating regulations and products catalyze demand for expert advisory. Clients rightly expect sophisticated guidance on investments, succession planning, taxes in this complex environment. The CFA designation assures skills navigating intricate financial regulations and instruments to tactically maximize after-tax returns within risk tolerances. Firms recognize genuine value in retaining industry authorities able to relate sophisticated strategies simply. Designations signal specialized knowledge commanding premium fees. Advisor scarcity pulls up earning power for qualified charterholders in private wealth management commanding six-figure incomes. Endorsement from high-net-worth clienteles further establishes the CFA as the epitome of professional excellence in finance.

Conclusion: The Reigning Financial Credential?

As the finance industry matures into a specialized field, employers and clients preference expertise over general business qualifications. Indications show the CFA surpassing MBAs as the preeminent certificate over the long run.

Its focused curriculum, flexible pathways supporting career development and global respectability lend the CFA unparalleled branding for aspiring and established finance professionals alike. While multiple options remain viable, the CFA lays strongest claim to the throne of preeminent financial credential going forward. Willingness to constantly upgrade oneself maintains its relevance beyond initial exams in an evolving world.